NPA Management System

check_box SMA MANAGEMENT

check_box RECOVERY MANAGEMENT

check_box EARLY WARNING SYSTEM

check_box AUTOMATIC NOTIFICATIONS

check_box PREDITIVE RISK ALERTS

check_box AI POWERED DASHBOARDS

check_box CALL CENTER INTEGRATION

check_box REPORTING ANALYSIS

check_box E-COURT INTEGRATION

check_box COURT PROCEEDINGS

check_box MOBILE APPLICATION

check_box AI POWERED DASHBOARDS

check_box CASE AGAINST BANK

check_box REVENUE RECOVERY

check_box OTS/E-OTS

check_box ADVOCATE EMPANELMENT

check_box MICRO-CREDIT ORGANISATIONS

check_box COOPERATIVE SOCIETIES

check_box MICRO FINANCE INSTITUITIONS

check_box SACCOS CREDIT UNION

Empowering Financial Solutions, Transforming Recovery and Risk Management

Empowering Financial Institutions with Comprehensive Debt Recovery, Litigation Management, and Risk Solutions. Our innovative AI-powered systems and expert services ensure streamlined processes, secure compliance, and enhanced decision-making for your organization.

World Active User

Comprehensive Debt Solutions

Streamline your recovery process with tailored strategies that adapt to your organization's needs, ensuring maximum efficiency and effectiveness in debt collection.

Proactive Dispute Resolution

Navigate conflicts with ease through our Pre-Litigation Lok Adalat services, promoting amicable settlements that save time and resources before heading to court.

Intelligent Risk Management

Stay ahead of potential issues with our Early Warning System, designed to detect and address signs of delinquency before they escalate, safeguarding your financial health.

AI-Driven Insights

Leverage our AI-powered dashboards for real-time analytics, enabling data-driven decision-making that enhances performance and identifies opportunities for improvement.

Seamless Legal Management

From case tracking to advocate empanelment, our Litigation Management services ensure your legal processes are organized, transparent, and efficiently executed.

AI-Driven Solutions

Unlock the future of financial management with AI-driven solutions that streamline litigation, debt recovery, enhance risk management, and provide real-time insights for smarter, more efficient decision-making.

Why Choose Us?

Discover how our innovative solutions set us apart in the financial services industry:

AI-Powered Efficiency

Comprehensive Service Offerings

Expertise in Compliance

Proven Success Record

Seamless Integration

Client-Centric Partnership

A flexible approach to venture debt

General enquiries

support@example.com

Customer sales enquiries

+1834 123 456 789

Flexible Financing.

A long-term capital partner over the life of your business.

Relationship Banking for SaaS.

We take a personal, partnership led approach to learn your business and help you build the right capital stack.

Transparent Terms.

Flexible, customized approach to finance structure. We'll customize what you need with no hidden terms.

Best features provided by FinPoan

Get control & visibility over every payment

- Advance analytics

- Easy payment

- Fully integrated

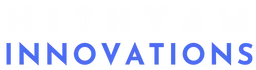

Issue virtual & physical cards with built-in rules

- Reduce risk

- Monitor spend

- Boost productivity

- Monitor spend

Manage and pay invoices easily

- Full visibility

- Save time

- Stay secure

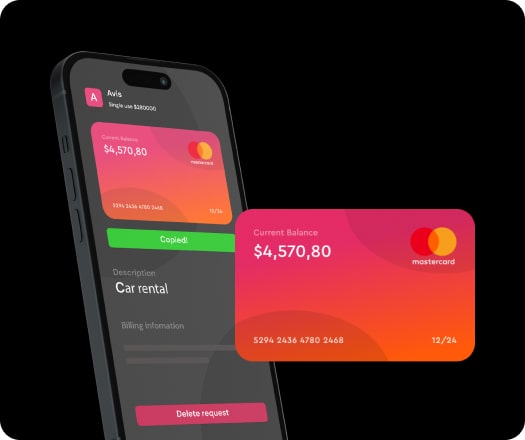

Monitor & optimise budgets in real time

- Finance

- Budget owners

- Virtual cards

- Spending reports

Empowering Financial Institutions for a Secure Future

In an ever-evolving financial landscape, NithyamInnovations is dedicated to transforming the way banks and financial institutions manage debt and litigation. Our innovative solutions ensure that you stay ahead of the curve, fostering resilience and efficiency.

“Tailored Solutions: Customized services that address your specific challenges and goals, ensuring maximum impact.

“Innovative Technology: Harnessing cutting-edge technology and AI to streamline processes, reduce costs, and enhance decision-making.

“Expert Support: A dedicated team of professionals providing guidance to help you navigate complex legal and financial confidently.

98% of customers say switching to FinPoan is easy.

Excellent

How It Works

You just Monitor results and continuously optimize legal workflows.

Connect Your Data

Integrate with your bank or institution's existing systems.

AI Processing

Finlitiai analyzes cases, predicts risks, and suggests optimal actions.

Automated Execution

Send reminders, update case statuses, and generate reports automatically.

Track & Improve

Monitor results and continuously optimize legal workflows.

Custom Alerts

Stay informed with automated reminders for hearings, filings, and deadlines